19+ Mortgage repayments

Thats more than double your potential interest savings. The information provided by this mortgage repayments calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre.

19 Mortgage Website Themes Templates Free Premium Templates

This means your monthly mortgage repayments will be higher because it includes your LMI.

. ANZ Flexible Home Loan. Six ways to pay off your mortgage early. For example there are 12 months in a year but 26 fortnights.

Interest is calculated daily and debited monthly. Inside Chinas property crisis as thousands boycott mortgage repayments. When your fixed rate mortgage ends.

Pay off your mortgage faster. Mortgage calculators open secondary menu. The insurer found that close to 2 million adults have no money left each month after paying their bills.

Dont have a mortgage and want to find out what your repayments could be and how long it could take to pay it off. Your top 10 money questions in te reo Māori Budgeting. Households suffer mortgage stress when 30 or more of their pre-tax household income is being swallowed by mortgage repayments.

The new system means higher or additional-rate taxpayers can no longer claim the tax back on their mortgage repayments as the credit only refunds tax at the basic 20 rate rather than the top rate of tax paid. Impact of the tough business environment in the real estate industry along with the continued impact of Covid-19. Once you understand the fees associated with extra payments and the way that your payments are applied to the principal you can come up with the best strategy to pay off your loan more quickly.

Get mortgage free faster. Use our Lenders Mortgage Insurance Calculator to calculate how much LMI you may need to pay. Calculate your estimated home loan repayments or see how refinancing could help save you money.

Investing Studying Budgeting Women KiwiSaver Managing debt COVID-19 Te Ao Māori Pasifika. You may need to pay just one large monthly payment on the loan in order to avoid fees and to pay it off as quickly as. How to apply for a mortgage open secondary menu.

ANZ Fixed Rate Home Loan. Decide whether an interest-only home loan is right for you. The interest rate doesnt change for the life of the loan.

Santander and Barclays hike repayments within hours of Bank of England imposing historic interest rate rise to 175 - as UK faces doomsday forecast of 13. The only solution for buyers is to boycott mortgage repayments and force the suspension of the. Life becomes stressful at this point because once.

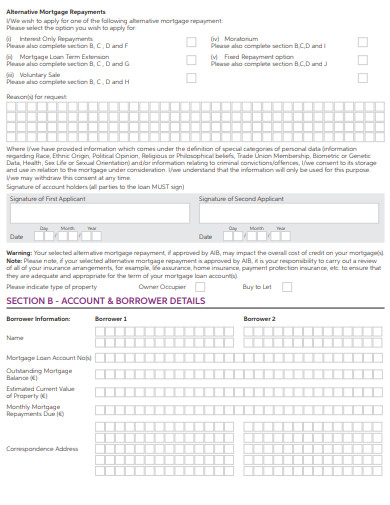

Mortgage Overpayments following a Covid 19 payment break. Residential buildings under construction in Shanghai China July 20 2022. Reduced Repayment Application Form for Alternative Mortgage Repayments - To be completed if you require an alternative repayment applied to your mortgage and your mortgage account is NOT currently being.

Get the latest home loan news and rate updates. Last chance for employers to claim September furlough payments. Up to 30 years.

Top up your mortgage. Work out your repayments before and after the interest-only period. In order to make sure he can make the repayments he turns to the chattel mortgage calculator to get an idea of what his repayments will be.

At the end of 19 years about the length of time it would take to pay your mortgage early you would have 160780. Choose the Best Strategy for Extra Payments. Fixed - 4 years.

Keeping your mortgage on track. You would like to borrow. How much will YOUR mortgage go up by.

Youll receive a fixed rate of 519 pa. If you have taken a Covid 19 payment break and would like to make an overpayment. As well as making extra repayments making more frequent repayments can also help you get ahead on your loan.

British households are on average only 19 days from the breadline according to research by Legal General LG. One year is assumed to contain exactly 52 weeks or 26 fortnights. For example if you had a 125000 mortgage balance and 25000 in a linked savings account your monthly mortgage interest would be calculated on 100000 rather than the full balance resulting in lower repayments.

If you make fortnightly repayments instead of monthly ones youre making one extra month of repayments per year which puts you slightly ahead. Borrow up to 95. Save a bigger deposit.

This implicitly assumes that a year has 364 days rather than the actual 365 or 366. ANZ Floating Rate Home Loan. Repayments are made monthly and all repayments are made on time.

Which home loan is right for you.

Free 26 Payment Receipt Samples In Pdf Ms Word Excel Apple Pages Numbers

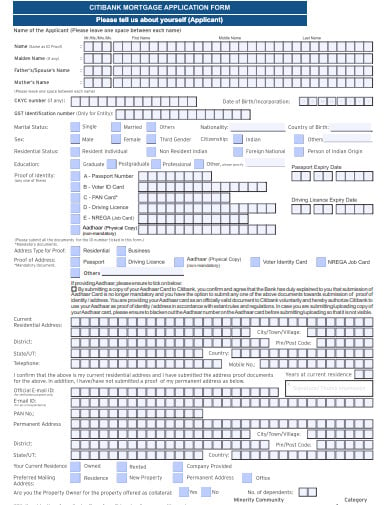

10 Mortgage Form Templates In Pdf Doc Free Premium Templates

10 Mortgage Form Templates In Pdf Doc Free Premium Templates

10 Mortgage Form Templates In Pdf Doc Free Premium Templates

Free 9 Mortgage Statement Samples And Templates In Pdf

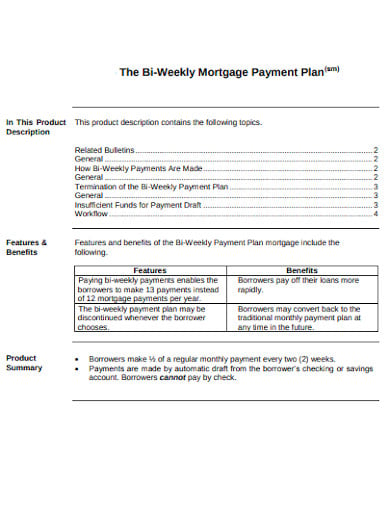

3 Biweekly Mortgage Templates In Pdf Free Premium Templates

Free 9 Mortgage Statement Samples And Templates In Pdf

True North Broker Group Facebook

Free 9 Mortgage Statement Samples And Templates In Pdf

Free 9 Mortgage Statement Samples And Templates In Pdf

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

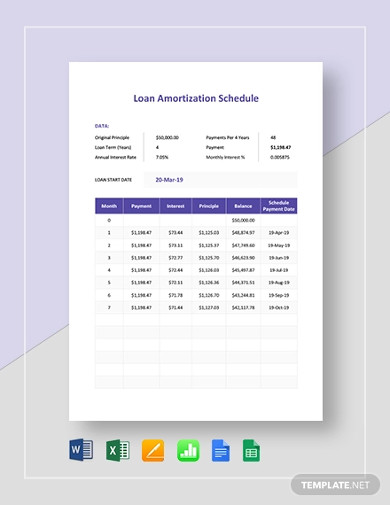

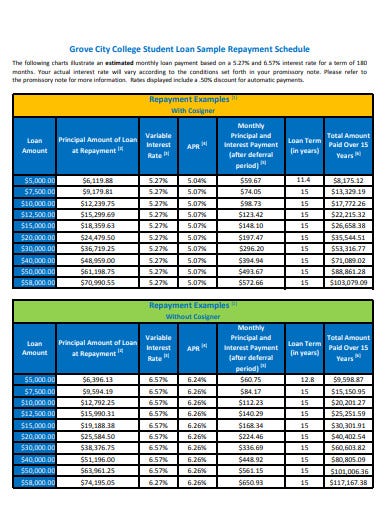

Loan Schedule 15 Examples Format Pdf Examples

19 Free Household Budget Templates Ms Office Documents Household Budget Template Budget Template Household Budget

10 Mortgage Form Templates In Pdf Doc Free Premium Templates

Loan Schedule 15 Examples Format Pdf Examples

Free 9 Sample Credit Card Payment Calculator Templates In Excel